According to Google search, “The basic purpose for a sales invoice is to keep a record of the sale. It provides a way to track the date a good was sold, how much money was paid and any outstanding debt.”

In the Philippines, if you are trading goods, a “sales invoice” is used to record the receivable to the customer and record the sale. Once you received the payment, companies should issue a collection receipt.

If you are a service company, people call it a “billing statement”, “billing invoice” or a “service invoice” or a “statement of account”. In any case, it is only to record the receivable, but it will not be an official sale because it is mandated by the BIR that you should register the sale upon issuing the Official Receipt or once you received the payment from the customer.

In any case, you have to apply to BIR for an Authority to Print (ATP) to use these forms. But if you are mandated or if you prefer to register a Computerized Accounting Software (CAS), then you can use a digital copy to print the forms.

So what should be the essential components of an invoice?

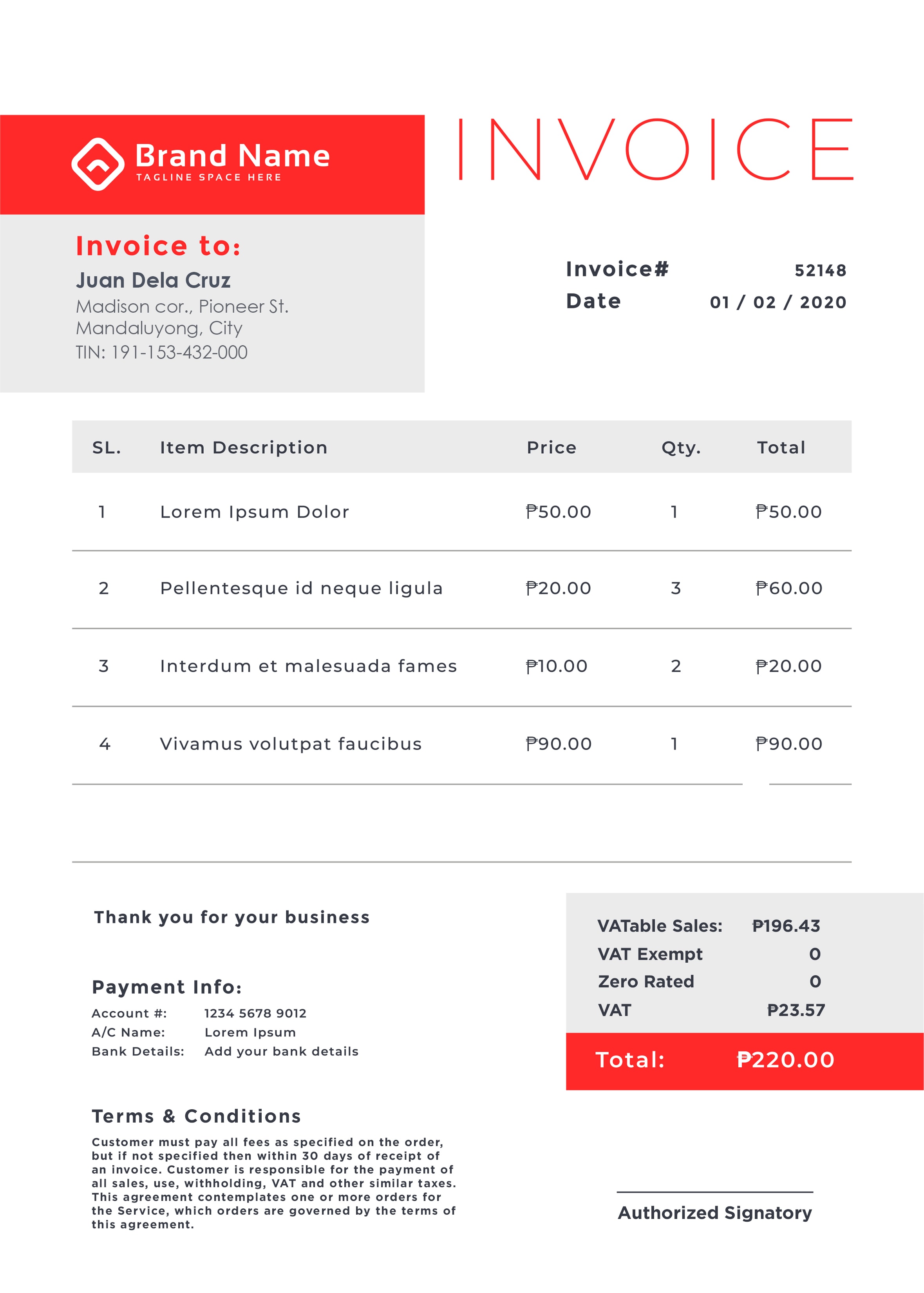

Here’s a typical sample of an invoice:

It is important to note the ff fields:

* Invoice # – this is a serialized invoice number that should be pre-registered in BIR’s ATP. This can be alpha-numeric.

* Date – this should be the date that the sale happened or the service was rendered.

* Customer – It is vital that the customer name is the registered name with its address and TIN number.

* Item details – this should be the product sold or the description of the service rendered. Amount inputted here should be inclusive of VAT.

* The bottom line should present the breakdown of VATable Sales, VAT Exempt and/or Zero-rated sales and the VAT amount.

* Footer notes – usually, footer describes the bank account details where the customer should remit the payment and/or the terms and conditions and the billing and collection authority personnel who will sign the sales invoice.